The election prospects of former President Donald Trump are already having an effect on the markets.

So-called “Trump trades,” a series of investments set to pay off should he get reelected, have started to unwind, according to a recent note from investment bank Macquarie.

One of the most prominent of such trades has been a bet on a stronger U.S. dollar. But as of Wednesday, the dollar’s DX-Y index (which measures the dollar against a basket of other currencies) is hovering right around its 2024 low. It’s fallen just under 3% so far in August.

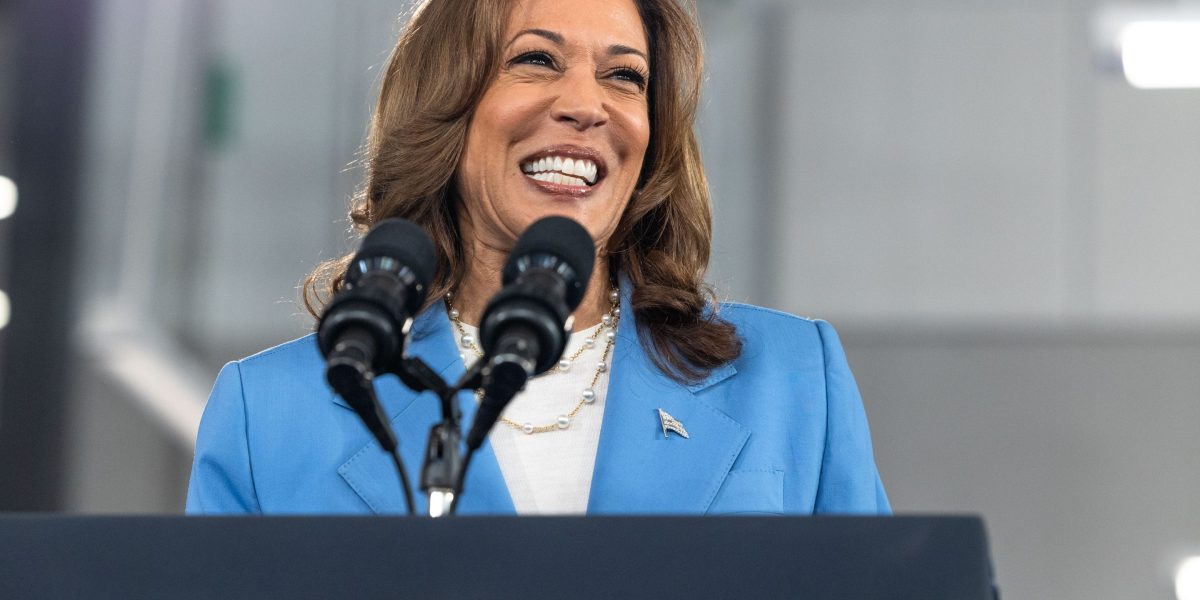

Now, with the victory of Vice President Kamala Harris looking more likely, the dollar could weaken further, Macquarie said.

“The weakness is partly attributable to the unwinding of the ‘Trump trade’, we believe, which had been built on the premise of more inflation and higher interest rates in the US, which would support the USD,” Macquarie Global FX & Rates Strategist Thierry Wizman told Fortune.

Macquarie already believed the dollar was weaker than it should have been. There were favorable indicators for the dollar, including a series of slumps in Asian stock markets and the central banks of the U.K. and the eurozone both cutting interest rates. But none of them raised the relative value of the dollar.

“That the U.S. dollar has weakened since early August is a bit weird, in our view, as it has come during a period in which the U.S. data (retail sales, initial claims, services ISM) has pointed to renewed relative strength in the US, following the worries about a lapse into recession during late July and early August,” Wizman wrote.

‘Kamala-mentum’

The explanation, Wizman and his team concluded, was that investors had decided to walk away from the “Trump trades” because they think the candidate who would make them happen might not win. Wizman points to the fact that many of the Trump trades started to unwind in the week immediately following President Joe Biden’s announcement that he wouldn’t seek the Democratic Party’s nomination. A few weeks later, in early August when the first polls showing Harris overtaking Trump came out, the DXY sagged. That was more circumstantial evidence that the Trump trades were indeed unwinding, according to Wizman.

The Harris campaign’s momentum, which Macquarie dubbed “Kamala-mentum,” would continue the weakening of the U.S. dollar as the Fed cuts interest rates, Macquarie says. With the Democratic National Convention in full swing, a post-convention bounce in the polls for Harris could even accelerate the dollar’s fall, according to Macquarie.

Backing off from the Trump trade seems to indicate that at least some investors are losing faith in Trump’s chances come November. However, with several months to go until the election any outcome is far from a foregone conclusion. Especially in a race such as this year’s that was so recently upended, according to Frank Kelly, senior political strategist at investment firm DWS. “July was Trump’s month, August was Harris’ month, and September is going to be an all out brawl,” he said.

The uncertainty as much as anything else is contributing to the pullback from the Trump trades. The latest polls show the two candidates within one to two percentage points of one another. Before Harris’s recent lead in some polls, Trump had been far ahead of Biden, seemingly cruising to a victory. No longer able to bet on a sure thing, investors adjusted.

A Trump victory might force the Fed to support the dollar

Until now investors had associated Trump with a stronger U.S dollar because they believed his priorities of blanket tariffs, drastically curbing immigration, and cutting taxes would be broadly inflationary, and that in turn would force the Fed to keep rates higher—which would raise its relative value on the international currency markets.

“In our view, Trump was perceived to be better—fundamentally—for a stronger U.S dollar than a Democratic administration would be,” Wizman wrote. “That’s because Trump’s core policies—tax breaks, restrictions on immigration, tariffs—would be deemed to be more inflationary, thereby keeping policy rates higher than otherwise.”

Ironically, Trump himself doesn’t favor a strong dollar. In the past Trump has argued that the dollar is too strong, which made it too expensive for foreign buyers to purchase U.S. goods. “We have a big currency problem,” Trump told Bloomberg in July.

‘Now they’ll start battering each other with policy issues’

Despite that, the majority of investors and economists expect Trump’s policies to do the opposite. “The market’s perception—and ours—is that Trump’s policies should be associated with higher policy interest rates than Harris’,” Wizman wrote in his note.

Throughout the early days of her campaign Harris has been relatively vague on policy. However, she’s started rolling more of them out over the last week. So far, her economic views include advocating for regulations against excessive price increases on consumer goods, building more housing stock, and eliminating taxes on tips (an idea first introduced by Trump).

The Harris campaign has telegraphed that will change over the coming weeks. The ongoing Democratic National Convention could serve as a starting point for a broader policy rollout. Kelly, the political strategist, thinks once that happens the election campaign will move into its next phase. “Now they’ll start battering each other with policy issues rather than it being personal,” he said.