Interest in home gardening continues to rise despite concerns about the economy and inflation. | Greenhouse Grower

The roller coaster ride the floriculture market has experienced over the last few years has, to a large degree, mirrored the changing consumer landscape. Because of this, it’s more important than ever for all segments of the industry to stay on top of where things are headed. The good news is that, even while predicting the green industry landscape is more challenging than ever, there are experts who can help.

Keep reading for a closer look at the market forces that will shape floriculture in 2025 and beyond.

Trendspotting Starts with Knowing Your Customer

There are perhaps no two individuals better equipped to help growers capitalize on trends than Dr. Charlie Hall of Texas A&M University and Dr. Melinda Knuth of North Carolina State University. In mid-November, the two of them partnered on a “Trends to Watch in 2025” webinar that was part of American Floral Endowment’s Grow Pro Webinar Series.

Dr. Knuth focused on how consumers are changing and evolving in their demographics, their values, and how they shop. Her insights can be broken down into four main themes:

1. When shopping, consumers want benefits instead of features. In other words, your focus should be more on “what can this plant do for my customer” than “what does this plant look like.” Specifically, it’s important to identify how the plants you offer reflect the quality-of-life metrics and benefits outlined by the World Health Organization back in 2012:

- Social

- Physical

- Psychological

- Cognitive

- Environmental

- Spiritual

It’s also important to note that you don’t have to do this alone. “Plants are the great social equalizer because green spaces are one of the few areas where everyone comes together,” Knuth says. “We need to work more as a unified front in this industry when it comes to focusing on plant benefits.”

2. Biodiversity is a key trend driving the benefits of plants. “We’ve become more urbanized than ever, and providing plants to urban green areas and those living in them will be critical,” says Knuth. “You should be thinking about how you can both provide and promote these plants.”

3. The country is more ethnically diverse than ever, and we need to change our marketing to reflect this. Whether it’s young white men or multi-generational ethnic families, consider how you are positioning your products to attract these consumers. This also includes adults without children; consider hosting kids-focused activities during the day and adult-oriented events in the evening.

4. Use an omni-channel path (in-store and online) for shopping. “The expectation of Gen Z is that they can buy anything online and either have it shipped to them or pick it up in-store,” Knuth says. “They might choose retailers who offer that option over those that do not.”

Why Consumer Sentiment Isn’t Always Reality

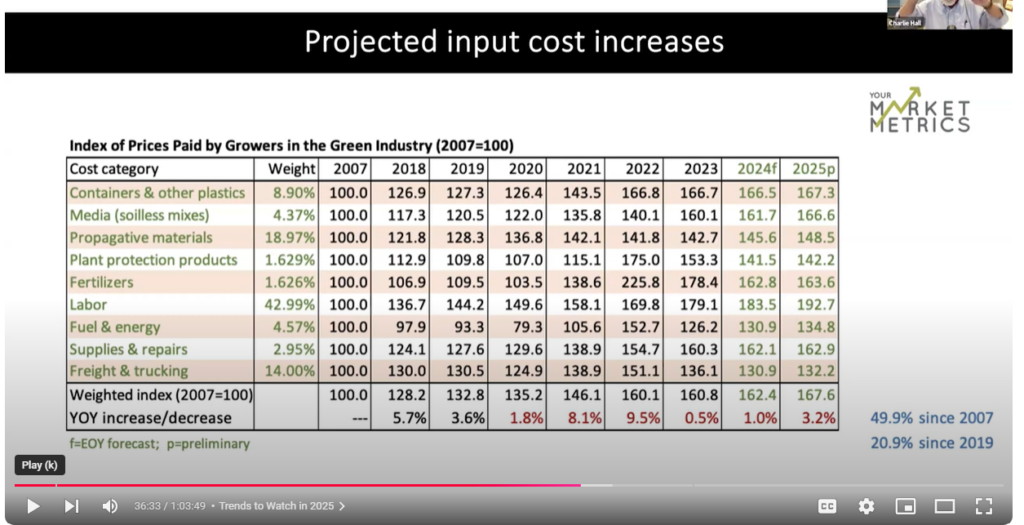

Dr. Hall offered a deep dive into key economic drivers shaping the green industry, including where we are right now compared to historical trends.

“2024 did show some signs of decline following the pandemic boom, and I have wondered if our industry would experience the same trends we saw in the past, when green goods sales dropped as durable goods rose,” Hall says. “The good news is that we remain well above pre-pandemic sales levels.”

Here are a few more rapid-fire insights from Dr. Hall’s presentation:

“When I ask growers about their perceptions as to why consumer purchasing slowed a bit, they mention weather, election uncertainty, inflation, and interest rates as the main reasons for softer demand for plants. But from the data, we still see consumer expenditures on certain luxury items rising, which tells me there’s a disconnect between how we feel and how we spend money.”

“People are still spending money (on eating out, travel, and boats!) despite how they tell us they feel. So, if they’re not buying plants, that’s on us as an industry. But again, while our sales have flattened, we have not gone back to pre-2019 levels, which is encouraging.”

“In the housing market, we already don’t have enough homes to satisfy demand. As rates come down, this demand will increase even more, which means we’ll see demand for our products increase as well.”

“The supply chain has largely recovered, although the impending tariffs from the incoming Trump administration may be a factor moving forward. But there is also a big difference between campaign promises and legislation, so we have time to figure out what the effects might be.”