TD Bank today pled guilty and agreed to pay over $1.8 billion in penalties to resolve the Justice Department’s investigation into violations of the Bank Secrecy Act (BSA) and failure to comply with anti-money laundering rules. Separately, the Financial Crimes Enforcement network penalized the New Jersey-based subsidiary of the Canadian banking giant $1.3 billion over the violations.

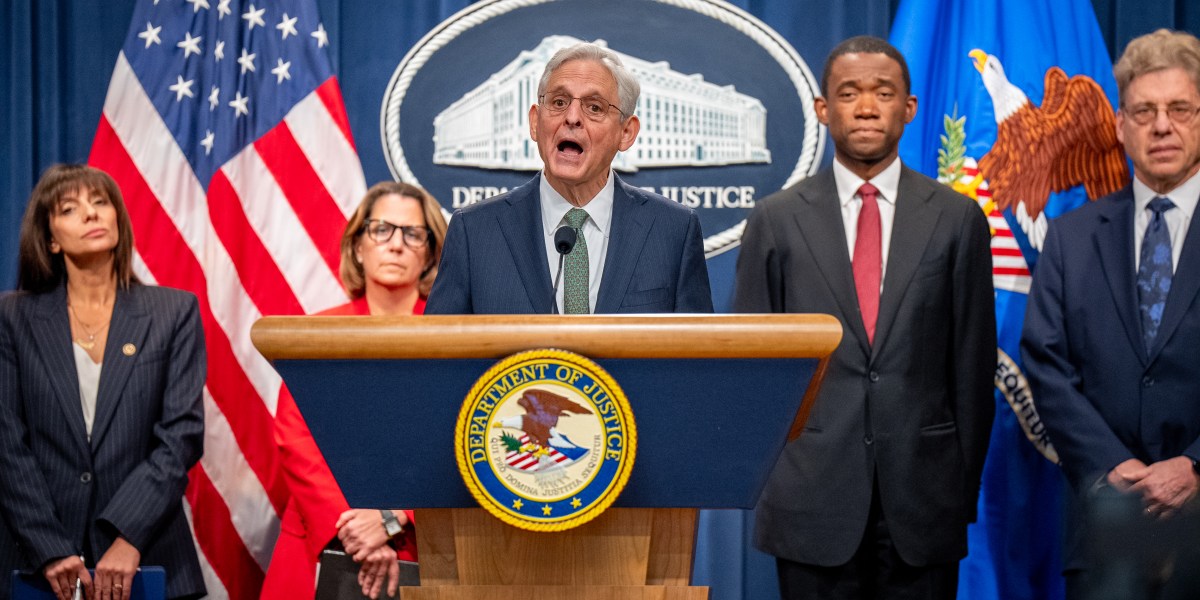

At a press event this afternoon, U.S. attorney general Merrick Garland said TD Bank was the largest bank in U.S. history to plead guilty to Bank Secrecy Act failures, and the first bank in history to plead guilty to conspiracy to commit money laundering. “By making its services convenient for criminals, it became one,” he said.

A statement from FinCEN called the $1.3 billion settlement “the largest penalty against a depository institution in U.S. Treasury and FinCEN history.” From January 2014 to October 2023, TD Bank had “long-term, pervasive, and systemic deficiencies in its U.S. AML policies, procedures, and controls,” according to the Department of Justice’s statement, “but failed to take appropriate remedial action.”

Senior executives at TD Bank enforced a budget mandate, referred to internally as a “flat cost paradigm,” requiring that TD Bank’s budget not increase year-over-year, despite its profits and risk profile increasing significantly over the same period. Although TD Bank maintained elements of an AML program that appeared adequate on paper, regulators say fundamental and widespread flaws in its AML program made TD Bank an “easy target” for perpetrators of financial crime.

This resulted in approximately $18.3 trillion of transaction activity from Jan. 1, 2018, to April 12, 2024 that went unmonitored, according to the statement. According to employees cited in the DOJ statement these failures made it “convenient” for criminals, allowing three money laundering networks to collectively transfer more than $670 million through TD Bank accounts between 2019 and 2023. From January 2018 to February 2021, one money laundering network processed more than $470 million through the bank through large cash deposits into nominee accounts.

As part of the settlement, according to the FinCEN statement, TD Bank admitted that it willfully failed to implement and maintain an AML program that met the minimum requirements of the BSA and FinCEN’s implementing regulations. FinCEN says its investigation showed that TD Bank knew its AML program deficient. Among other failures, TD Bank processed transactions on Venmo and Zelle that were “indicative of human trafficking” and as a result of the deficiencies, “failed to identify and timely report these transactions” to the regulator.

“The vast majority of financial institutions have partnered with FinCEN to protect the integrity of the U.S. financial system. TD Bank did the opposite. From fentanyl and narcotics trafficking, to terrorist financing and human trafficking, TD Bank’s chronic failures provided fertile ground for a host of illicit activity to penetrate our financial system,” said Deputy Secretary of the Treasury Wally Adeyemo in the statement.