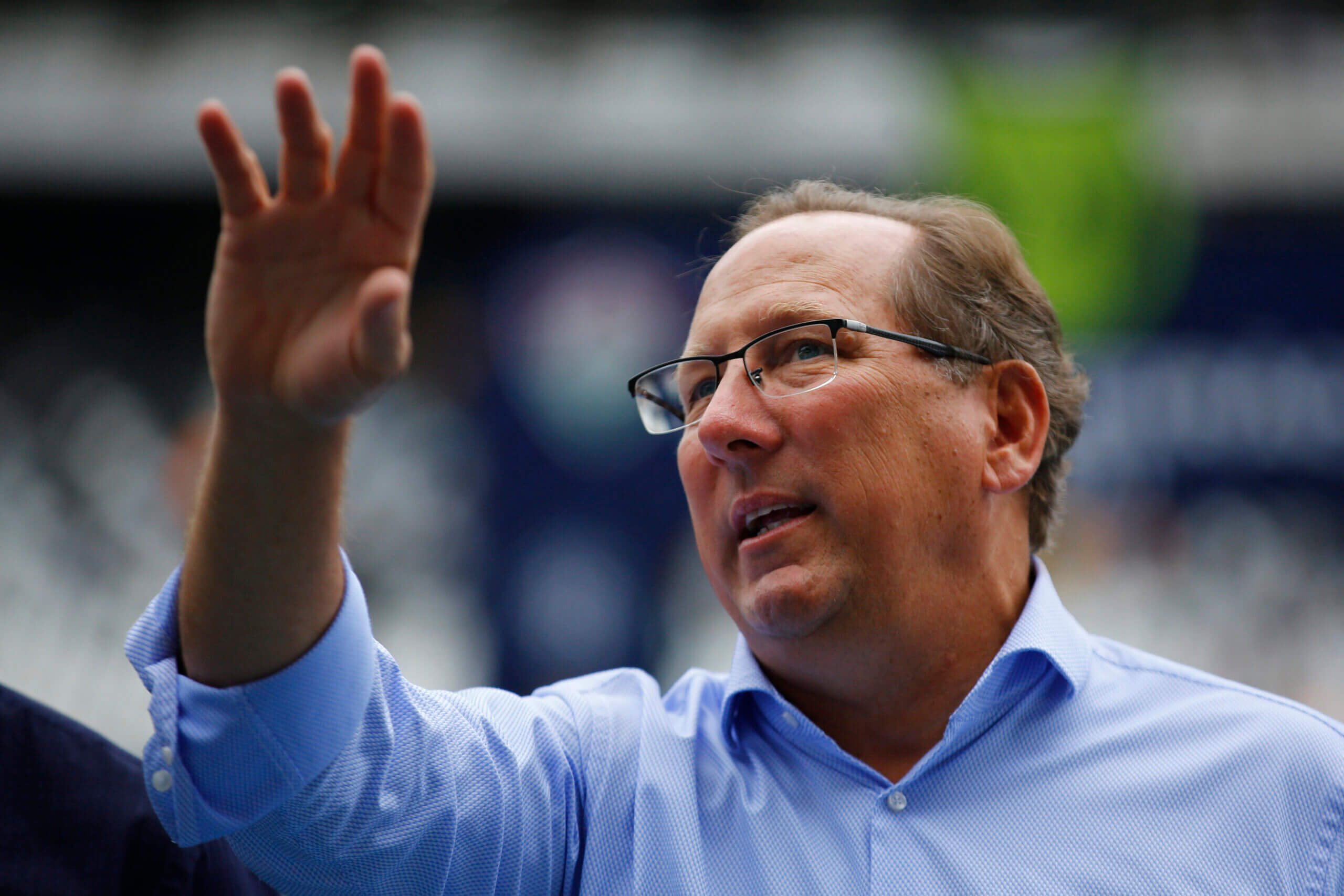

American businessman John Textor has entered a period of exclusivity to pursue the purchase of Farhad Moshiri’s majority stake in Everton.

Textor has signed agreements in place with Moshiri and the Merseyside club. A spokesperson for Moshiri declined to comment when contacted by The Athletic.

Any potential deal is contingent on the 58-year-old selling his 45 per cent stake in Crystal Palace, which he holds through his Eagle Football Group.

Premier League rules forbid ownership of two clubs in the same division.

In May, Textor engaged investment banking firm Raine Group to actively seek a buyer for Eagle Football’s stake in Palace and said he was exploring the purchase of alternative English clubs, including Everton.

In July, it was confirmed The Friedkin Group’s (TFG) proposed purchase of Moshiri’s 94 per cent stake in Everton was off, with the news coming less than two months after a proposed takeover by Miami-based private investment firm 777 Partners fell through.

TFG, the Texas-based owner of Italian side AS Roma, had emerged as a favourite to buy Everton and in June entered a period of exclusivity to acquire Moshiri’s stake in the club.

GO DEEPER

Everton takeover: Why the Friedkin Group deal is off and what happens now?

However, the group withdrew from negotiations, citing concerns about the club’s £200million ($258m) debt to 777. U.S. investors MSP Sports Capital also withdrew from talks about taking a minority stake in the club in August 2023.

Palace, meanwhile, are run by four general partners — chairman Steve Parish, Textor and fellow U.S. businessmen Josh Harris and David Blitzer.

In 2015, Harris and Blitzer each purchased an 18 per cent stake in the club to join Parish. Textor became the fourth general partner in 2021 when he took a 40 per cent stake after investing £87.5million.

He injected a further £30m ($38.5m) into the club last year to increase his shareholding by a further five per cent.

Speaking to The Athletic in May, Textor said: “Yes (I’ve had conversations around buying Everton). With the existing constituents – different groups, different lenders, different equity holders.

“I’ve asked them ‘is there a way to solve all this confusion and address everyone’s problems?’ I’m very open-minded to it but I don’t want to come into a situation where I’m not really welcome.”

Moshiri bought Everton in 2016 but has overseen a decline in performance both on and off the pitch.

The club posted losses of nearly £400m ($509.6m) between 2019 and 2023, leading to two breaches of the Premier League’s profitability and sustainability rules (PSR) and resulting in a total deduction of eight points.

“Everton represents the best of English football: the struggles, the glory, the want,” Textor said in May. “I love that it’s out of London. Everybody should want to buy Everton right now.

“That kind of club is what I’m referring to, where the risk and the reward of your relationship and community is so great and you could come in, make promises and keep them. How great would it be to take one of these great English clubs back to sort of glory?

“We’re also looking at other opportunities and we don’t need to jump right out of Palace right into something. That’d be a mistake.

“I suspect that the problem with Everton is it won’t be available by the time we would be ready for it. You can’t own two clubs in one league and we’re not going to rush the situation at Palace, no matter how good another opportunity looks.”

Eagle Football also owns majority stakes in Brazilian first division side Botafogo, Belgian side RWD Molenbeek and Ligue 1 club Lyon.

Everton begin the new Premier League campaign at home to Brighton & Hove Albion.

(Wagner Meier/Getty Images)